Get the weekly summary of crypto market analysis, news, and forecasts! This Week’s Summary The crypto market ends the week at a total market capitalization of $2,17 trillion. Bitcoin continues to trade at around $62,300. Ethereum experiences no changes and stagnates at around $2,400. XRP is down by 2%, Solana by 1%, and Dogecoin by 3%. Almost all altcoins are trading in the red, with very few exceptions. The DeFi sector decreased the total value of protocols (TVL) to around…

Polkadot Shines – Is Now The Time To Buy DOT Before $10?

Polkadot, a blockchain platform designed for interoperability between different blockchains, is experiencing a surge in new users, but a disconnect between user growth and network activity is raising questions about its long-term viability.

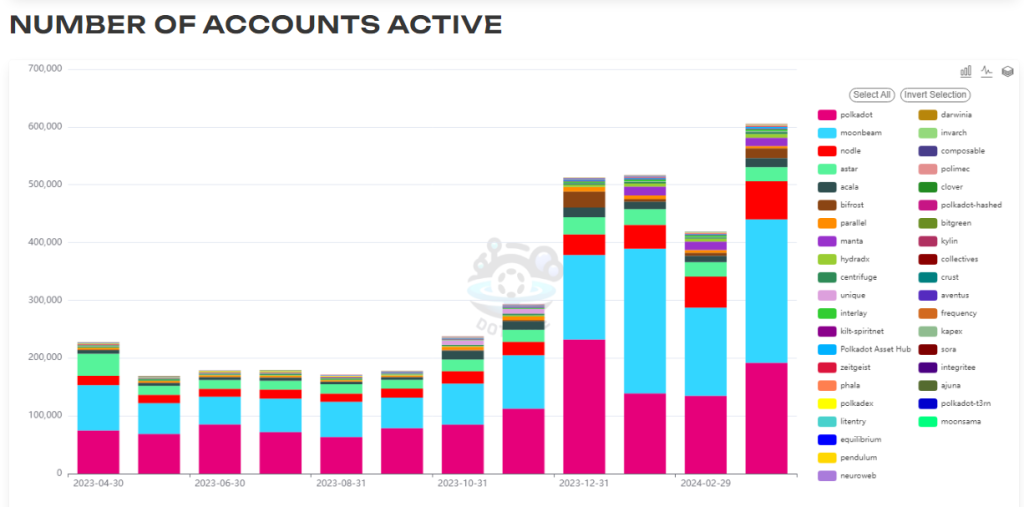

Based on the latest figures, DOT tallied an all-time high in active wallets and unique accounts in March, surpassing 600,000 and 5.59 million, respectively. This suggests a growing interest in the platform, potentially driven by the thriving developer ecosystem on Polkadot’s parachains, specialized blockchains that connect to the main Polkadot chain. Moonbeam, a prominent parachain, played a particularly significant role, contributing the highest number of active addresses with nearly 250,000.

Polkadot Transactions Dip Despite Active User Growth

However, despite the influx of new users, the number of transactions on the Polkadot network hasn’t kept pace. While there was a modest increase in transactions compared to February, the current volume remains significantly lower than the peak recorded in December.

This inconsistency raises concerns about how actively users are engaging with the network. The possibility exists that users are holding or staking their DOT tokens instead of utilizing them for transactions on the platform.

Polkadot Price Seeks Stability After Recent Decline

The price of Polkadot’s native token, DOT, seems to be finding support around $9. This could indicate a period of consolidation after a decline from its previous highs above $11. While a price increase is typically seen as a positive sign, it’s important to consider it alongside actual network usage.

Is Polkadot Building Without Using?

The current situation with Polkadot presents a paradox. The platform is attracting new users, but they aren’t necessarily translating into active network participants. This could be due to several factors. Perhaps users are waiting for a specific application or service to be built on Polkadot before actively engaging. It’s also possible that technical limitations are hindering user activity.

Further analysis is needed to understand the reasons behind the lagging transactions. Examining the types of transactions occurring on the network could provide valuable insights. For instance, an increase in governance-related transactions might suggest a more engaged user base, even if overall transaction volume remains low.

Polkadot’s Future Hinges On Active Network Use

While the growth in active wallets and accounts is a positive sign for Polkadot, it’s crucial to convert this interest into actual network usage. The success of Moonbeam demonstrates the potential for a vibrant developer ecosystem on Polkadot. However, broader adoption across various use cases is necessary for the platform to reach its full potential.

Featured image from Pexels, chart from TradingView

Bitcoin Layer-2 Platform Mezo Launches With $21M Series A Funding

Bitcoin Below $70,000: Is $80K Still Possible, Or Is The Rally Over?

Written by

More author posts

Publish your own article

Guest post article. Guaranteed publishing with just a few clicks

START PUBLISHING ADVERTISE WITH US