Get the weekly summary of crypto market analysis, news, and forecasts! This Week’s Summary The crypto market ends the week at a total market capitalization of $2,17 trillion. Bitcoin continues to trade at around $62,300. Ethereum experiences no changes and stagnates at around $2,400. XRP is down by 2%, Solana by 1%, and Dogecoin by 3%. Almost all altcoins are trading in the red, with very few exceptions. The DeFi sector decreased the total value of protocols (TVL) to around…

Keeping Consensus: Explaining Ethereum’s Difficulty Bomb

Ethereum’s difficulty bomb is a tool for maintaining network consensus between all classes of participants. This is a challenging task for Ethereum compared to Bitcoin, which performs frequent backward-incompatible hard forks.

The most significant of these – is Ethereum 2.0; the difficulty bomb will ensure the community’s smooth transition to the new protocol.

Review: Ethereum 2.0 and Proof Of Stake

To understand the necessity of the bomb, we must review some of Ethereum’s history.

Ethereum uses a proof-of-work consensus mechanism but has always planned to transition to proof-of-stake eventually. Vitalik Buterin – author of Ethereum’s whitepaper –favors proof-of-stake as a more economically and environmentally efficient consensus.

Proof-of-work requires network nodes to expend energy solving challenging math problems to ‘mine’ blocks. Nodes spending this energy are known as ‘miners.’

Miners are rewarded with all transaction fees associated with their respective block and newly generated Ether for spending this energy. Given these incentives, many have turned mining Ether and Bitcoin into profitable businesses, heavily investing in computer material to maximize profits.

However, these miners will lose business when Ethereum 2.0 and proof-of-stake are implemented. They will no longer be able to profit from their energy expenditure. Instead, block validators will be selected based on how much ETH they decide to stake. As such, some may be incentivized to stay around and continue mining Eth on the old network, even after the upgrade.

If done en masse among miners, this could create discord within the Ethereum community about which fork – Ethereum or Ethereum 2.0 – is the official Ethereum chain. However, as long as the first chain maintains legitimacy, the Ether on that chain will retain market value. Thus, miners could remain profitable, continuing to expend energy and defeating the whole purpose of the Ethereum 2.0 transition.

This is where the difficulty bomb comes in. The bomb refers to an exponential increase in the difficulty of mining blocks once a particular block height is reached. This doomsday period – also called the “ice age” – would bring the old Ethereum network to a screeching halt. Moreover, it would financially disincentivize miners from continuing operations, making transactions unfeasibly expensive for users.

When Will The Bomb Be Activated?

In truth, the bomb was scheduled to activate years ago. However, various developer troubles implementing a smooth Ethereum 2.0 transition have repeatedly inspired the community to delay it.

Five Ethereum upgrades have pushed back the Ethereum difficulty bomb’s date. They include:

- Byzantium update; 2017

- Constantinople update; 2019

- Muir Glacier update; 2020

- London update; 2021

- Arrow Glacier update; 2021:

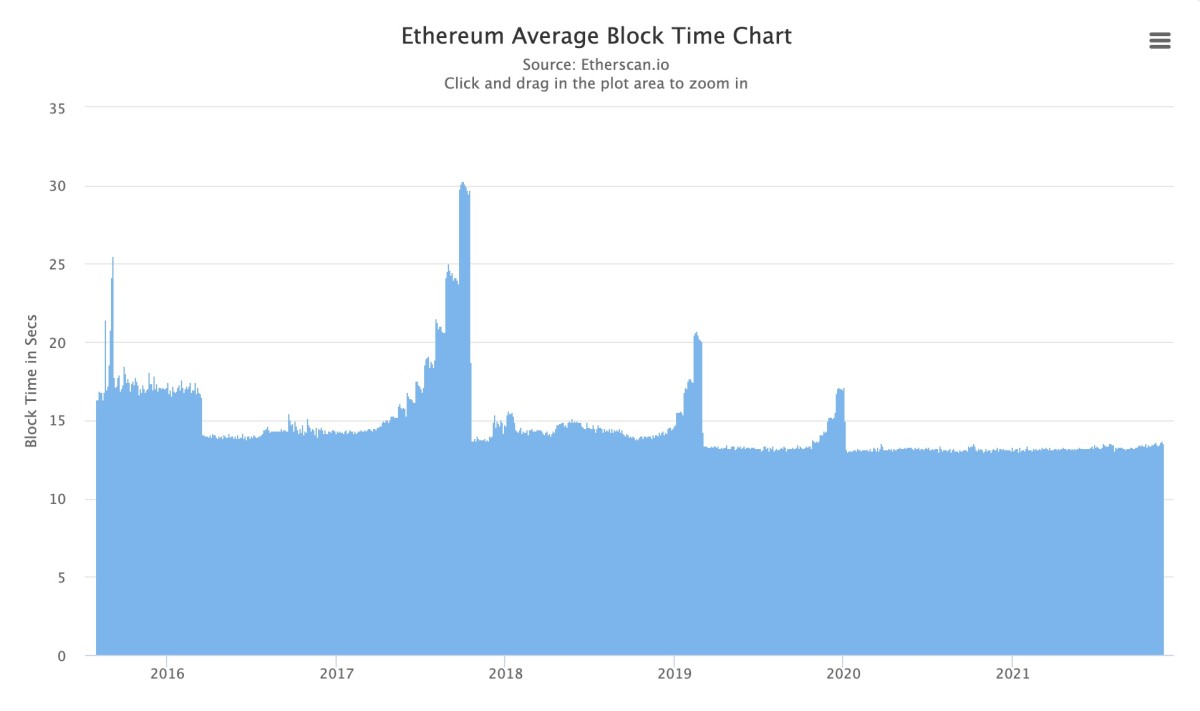

Notably, it implemented the two ‘Glacier’ updates to delay the difficulty bomb, which the community has accidentally encountered multiple times. Before being delayed, this chart tracking Ethereum block times illustrates the initial signs of numerous ice ages.

While acting as a motivator to move the community to Eth 2.0, the bomb keeps the community in constant motion. In Vitalik’s words, it “prevents protocol stagnation” by ensuring that the community adopts a culture and habit of frequent upgrades – even if to delay the bomb.

Today, the next bomb is scheduled to activate in June 2022. Vitalik claims that Ethereum 2.0’ should be ready to implement by then, making the network more than halfway complete.

How Does Bitcoin Upgrade?

Bitcoin doesn’t use a difficulty bomb to coerce users and miners to a new protocol version. It doesn’t need one, either.

Bitcoin’s only successful upgrades have been backward-compatible soft forks. The community and developers behind it actively resist hard-fork attempts, considering them overly coercive and antithetical to Bitcoin’s goals.

While Ethereans constantly push new technological frontiers, Bitcoiners make conservatism part of their value proposition. To become a new bedrock of the financial system, it strives to be stable and resistant to change.

However, in 2017, Bitcoin experienced one community rift where miners attempted to split the chain through a hard fork. Unlike Ethereum’s example, miners were the active party in this case, while the rest of the community was interested in keeping the old rules. As a result, the proposed upgrade – known as SegWit2x – would increase miners’ profits at the expense of decentralization.

However, the community ultimately stood together, implementing an alternative soft-fork upgrade and broadcasting it through their nodes. Afraid of the rift it would cause, miners conceded to the other nodes and implemented the upgrade.

The solution – whereby nodes united to upgrade a protocol altogether – became known as a “User-activated soft fork” (UASF).

Conclusion

Ethereum’s difficulty bomb was designed with the possibility of a minor revolt against protocol upgrades. Instead, it should be a powerful tool for keeping the protocol control users, developers, and nodes – not just those with hash power.

Pakistan Central Bank Proposes Total Crypto Ban

Former MP Predicts Tonga Will Make Bitcoin Legal Tender By November

Written by

More author posts

Publish your own article

Guest post article. Guaranteed publishing with just a few clicks

START PUBLISHING ADVERTISE WITH US