Get the weekly summary of crypto market analysis, news, and forecasts! This Week’s Summary The crypto market ends the week at a total market capitalization of $2,17 trillion. Bitcoin continues to trade at around $62,300. Ethereum experiences no changes and stagnates at around $2,400. XRP is down by 2%, Solana by 1%, and Dogecoin by 3%. Almost all altcoins are trading in the red, with very few exceptions. The DeFi sector decreased the total value of protocols (TVL) to around…

Millennium’s $2 Billion Bet on Bitcoin ETFs Signals Institutional Confidence

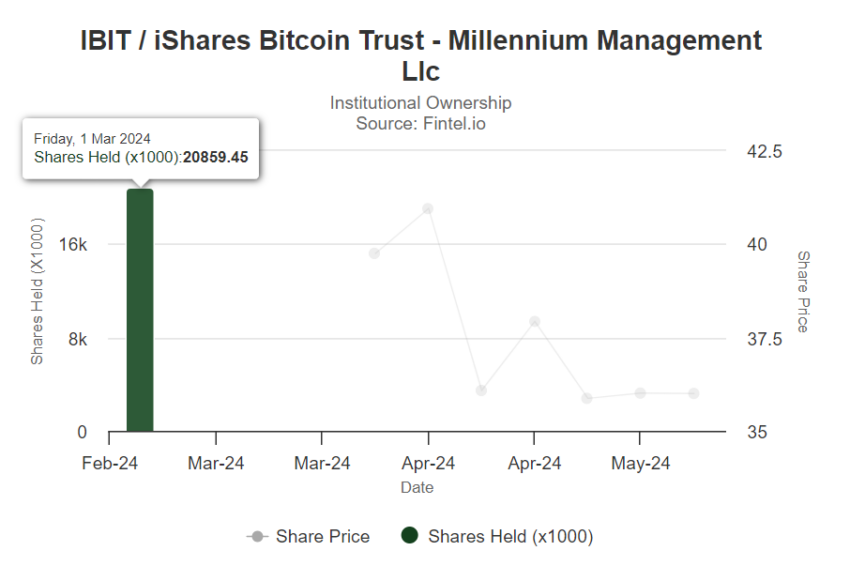

Millennium Management, a global investment firm with over $60 billion in assets, has disclosed its significant Bitcoin exchange-traded fund (ETF) holdings for the first quarter of 2024.

According to a recent 13F filing with the Securities and Exchange Commission (SEC), Millennium holds approximately $1.9 billion in various US-traded spot Bitcoin ETFs.

Institutional Bitcoin ETF Investments Surge

The firm’s largest holdings include BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and the Grayscale Bitcoin Trust ETF (GBTC). In addition, Millennium holds smaller stakes in the ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB). Specifically, the filing details Millennium’s investments as $844.2 million in IBIT, $806.7 million in FBTC, $202 million in GBTC, $45 million in ARKB, and $44.7 million in BITB.

Other prominent asset managers are also increasing their Bitcoin ETF holdings. Pine Ridge reported $205 million in IBIT, FBTC, and BITB. Meanwhile, Schonfeld Strategic Advisors disclosed $248 million in IBIT and $231.8 million in FBTC, totaling $479 million.

Matt Hougan, Chief Investment Officer at Bitwise, highlighted the significant trend of institutional investment in Bitcoin ETFs. According to Hougan, approximately 563 professional investment firms reported owning $3.5 billion worth of Bitcoin ETFs last Thursday. By the filing deadline, he anticipates that the market may see over 700 professional firms and total assets under management (AUM) approaching $5 billion.

“This is absolutely massive. For any financial advisor, family office, or institution wondering if they were the only one considering Bitcoin exposure, the answer is clear: You are not alone,” Hougan affirmed.

Hougan compared the interest in Bitcoin ETFs to that of gold ETFs launched in 2004, which were considered highly successful. Gold ETFs attracted over $1 billion in their first five days, with just 95 professional firms invested at the initial 13F filing.

“From a breadth of ownership perspective, the Bitcoin ETFs are a historic success,” he said.

Although most Bitcoin ETF investments are currently from retail investors, Hougan noted a potential for a growing trend among institutions. For instance, Hightower Advisors has $68 million allocated to Bitcoin ETFs, just 0.05% of their assets. Hougan predicts that such allocations will increase over time, potentially reaching significant proportions within institutional portfolios.

“Multiply that by the growing number of professional investors participating in the space, and you can begin to see what’s behind my enthusiasm,” he explained.

Indeed, substantial investments by institutions like Millennium Management underscore the growing integration of cryptocurrency into mainstream financial portfolios. This increased institutional backing signals long-term confidence in digital assets’ potential, potentially paving the way for broader crypto adoption.

The post Millennium’s $2 Billion Bet on Bitcoin ETFs Signals Institutional Confidence appeared first on BeInCrypto.

Cadia Coin Presents Seamless Trading Feature with EVM Compatibility

CME Group Plans Spot Bitcoin Trading Launch to Meet Wall Street Demand

Written by

More author posts

Publish your own article

Guest post article. Guaranteed publishing with just a few clicks

START PUBLISHING ADVERTISE WITH US