Get the weekly summary of crypto market analysis, news, and forecasts! This Week’s Summary The crypto market ends the week at a total market capitalization of $2,17 trillion. Bitcoin continues to trade at around $62,300. Ethereum experiences no changes and stagnates at around $2,400. XRP is down by 2%, Solana by 1%, and Dogecoin by 3%. Almost all altcoins are trading in the red, with very few exceptions. The DeFi sector decreased the total value of protocols (TVL) to around…

Weekly Crypto Outflows Reach $305 Million, Bitcoin Takes Biggest Hit

Bitcoin (BTC) is showing resilience despite the shifting sentiment in the crypto markets, with weekly outflows reaching $305 million. This shift follows stronger macroeconomic data from the US, leading to a change in market focus.

Historically, September has been a challenging month for Bitcoin, with the cryptocurrency often underperforming during this period.

Crypto Investments Record $305 Million Outflows

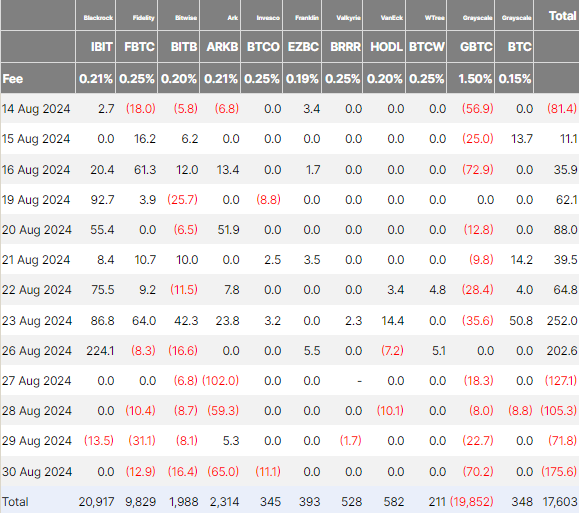

According to the latest CoinShares report, Bitcoin led the negative flows last week with $319 million in outflows. Meanwhile, short Bitcoin investment products saw a second consecutive week of inflows totaling $4.4 million. Ethereum followed with $5.7 million in outflows.

Most of Bitcoin’s outflows were recorded in the US, reflecting a shift in sentiment, especially with the underperformance of BTC and ETH ETFs. Data from Farside Investors also indicates increasing bearishness in Bitcoin ETF flows, with BlackRock’s iShares Bitcoin ETF (IBIT) recording its first outflow in nearly four months last week.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

On September 2, US markets will be closed for Labor Day, meaning financial markets, including ETFs, will be inaccessible to institutional investors. This could lead to even lower inflows this week if the current trend persists. James Butterfill, a CoinShares researcher, attributes the declining ETF inflows to changes in the US macroeconomic environment.

“We believe this was driven by stronger-than-expected economic data in the US, which has diminished the likelihood of a 50-basis point interest rate cut. We continue to expect the asset class to become increasingly sensitive to interest rate expectations as the FED gets closer to a pivot,” the report read.

Indeed, the Federal Reserve hinted at potential rate cuts during the Jackson Powell speech, following a trend of easing inflation that led them to keep interest rates steady at 5.25%—5.50%. With key US economic events, including the Consumer Price Index (CPI) and Fed interest rate decisions, scheduled for September, there is increasing optimism about the US economic outlook.

However, this could spell trouble for the crypto markets, with Bitcoin potentially facing more negative sentiment as investors adjust to the economic developments.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

The sentiment becomes more concerning considering historical performance data suggests a grim picture for Bitcoin in September. Data from Coinglass shows that Bitcoin has consistently underperformed during this month, with an average return of -4.78% since 2013.

The post Weekly Crypto Outflows Reach $305 Million, Bitcoin Takes Biggest Hit appeared first on BeInCrypto.

Why OMERTA Game Airdrop is the Best Crypto Giveaway in 2024

6 Best New Token Presales to Invest In Early For 2025 Crypto Bull Run

Written by

More author posts

Publish your own article

Guest post article. Guaranteed publishing with just a few clicks

START PUBLISHING ADVERTISE WITH US