Get the weekly summary of crypto market analysis, news, and forecasts! This Week’s Summary The crypto market ends the week at a total market capitalization of $2,17 trillion. Bitcoin continues to trade at around $62,300. Ethereum experiences no changes and stagnates at around $2,400. XRP is down by 2%, Solana by 1%, and Dogecoin by 3%. Almost all altcoins are trading in the red, with very few exceptions. The DeFi sector decreased the total value of protocols (TVL) to around…

Why Your Favourite Athletes Are In Love With Crypto

Since Bitcoin took off late last year, word of either cryptocurrency, blockchain or NFTs has permeated almost every conceivable industry. But, of course, some groups show greater interest in the space than others.

Some market participants – while exciting – aren’t exactly surprising. Elon Musk, Michael Saylor, and Jack Dorsey – all Bitcoin lovers and billionaires – are tech nerds running tech companies. One would expect them to be the first to grapple with an industry at the forefront of such financial innovation.

However what’s been more surprising is the emergence, promotion, and utilization of crypto by athletes and the broader sports industry.

The connection is hard to ignore. Coinbase – a popular cryptocurrency exchange – is now regularly promoted by the NBA, NHL, and throughout ESports. More recently, the largest sports arena in the world was claimed by Coinbase’s competitor exchange, Crypto.com. Apps for both businesses reached the top of the app store in October, which is likely no coincidence.

Yet, the most intriguing activity is not the sports leagues but the individual players. Athletes across every significant sport are launching NFT collections, forming industry partnerships, and even paying in cryptocurrency. Involved parties range from Lionel Messi to Tom Brady to Steph Curry, to name a few.

Why the sudden interest? More importantly, should we be following in these superstars’ footsteps?

Here’s why all of your favourite athletes are suddenly in love with crypto.

Receiving Salary in Bitcoin

Cryptocurrencies – particularly Bitcoin – have seen significant adoption as means of payment for products and labour in 2021.

Technological development has generally spurred this phenomenon. Also, developers have finally addressed the scalability issues that plagued the Bitcoin network for years. As a result, the network obtained practical support and global transaction volume.

Bitcoin transaction throughput was limited to whatever its base layer blockchain could record for almost all of its history. Stored in 1-megabyte blocks produced every ten minutes, Bitcoin could support roughly seven transactions per second (tps). That’s orders of magnitude less than traditional payment processors like Visa, which can reportedly process up to 24 000 tps.

All of that changed with the rise of the lightning network. Lightning is a layer 2 Bitcoin scaling solution designed to decongest Bitcoin’s base layer while reducing once erroneous transaction fees. In addition, lightning could theoretically process infinite transactions using private payment channels and deferred transaction settlements.

More volume is now processed over the Bitcoin network than over Paypal, thanks to lightning. In addition, local micropayments and international remittances are being sent over lightning instantly at near-zero fees. El Salvador – which made Bitcoin legal tender in September – currently uses lightning to support payments across the country.

Salary Payments in BTC

Concerning salaries, numerous services have launched around lightning to facilitate receiving a Bitcoin-based income. For example, Strike – a custodial wallet built around lightning – launched a “pay me in Bitcoin” service in October. It allows users to have any portion of their regular fiat income automatically converted into Bitcoin without fees. Employers need to have no familiarity with Bitcoin, and Strike can handle the back-end conversion.

Major players are taking advantage of the service. Francis Suarez – Mayor of Miami and avid Bitcoin bull – is using it to receive his entire salary in Bitcoin. Other city employees, including Miami’s CIO Mike Sarasti, are also taking advantage.

That brings us to the sports world. For example, a top Australian baseball club known as “Perth Heat” has used lightning to fully adopt a Bitcoin standard through a Bitcoin another payment provider called OpenNode. Besides converting its balance sheet from dollars into Bitcoin, the team has made it “the new standard for payments and payouts” to staff and players.

The infrastructure enabling workers, businesses, and athletes to receive a Bitcoin income is firmly established. But who would be interested in such a thing – and what for?

Why A Bitcoin Salary Is Attractive

If you’re a cynic, you may believe that athletes’ interest in Bitcoin and crypto is all a publicity stunt. Indeed, promoting crypto –especially asking for it – is an easy way to make headlines, and get popular with a new audience. It’s also a great way to drum up controversy, as most still view Bitcoin as a highly speculative asset.

But the sports world has its reasons for stacking sats – especially ahead of other areas of society.

Inflation Hedging

From Michael Saylor to JP Morgan, Bitcoin is becoming widely regarded as a savings vehicle, akin to “digital gold”. Some investors – such as Paul Tudor Jones – even prefer it to the real thing.

Such assets are imperative during extra-inflationary times like these. According to Labor Department statistics, annual inflation this October surpassed 6.2% – the highest rate in 30 years.

Meanwhile, Bitcoin reached a new all-time high at $69k immediately after the news dropped. YoY, it has produced over 100% average returns since 2013. Though it may seem risky or volatile in the short term, it has maintained a consistent upward trajectory across time. In fact, not a single person has lost money in Bitcoin after holding it for at least four years.

The distinction is even stronger in countries with weaker currencies than the United States. For example, although Bitcoin was down on the week in US markets, it hit an all-time high against the Turkish Lira late last month. While the local currency continues to collapse, Bitcoin becomes an ever more popular vehicle for value storage. As Mahmut Akdemir – a public servant of Turkey – said on the matter: “I think the gold of the new world is Bitcoin.”

Jack Mallers – founder of Strike – considers inflation hedging the primary benefit of his “pay me in Bitcoin” service. Regarding today’s unaffordable housing and asset prices, he sees saving in Bitcoin as absolutely imperative for younger generations.

“How does one save up for a house? Also, how does one ensure they’re retired at a reasonable age? How do you save to make sure your kids’ college tuition is paid for? Surely the answer is not the US dollar.”

With a fixed 21 million unit supply, Bitcoin protects against the standard debasement undergone by fiat currencies worldwide.

Youth

Naturally, athletes are a younger demographic. As with many new technologies, younger generations have been quickest to adopt/ adapt to cryptocurrencies.

A CNBC millionaire survey shows that almost half of millennial millionaires have at least 25% of their wealth in cryptocurrencies. Meanwhile, more than a third of them have half of their wealth in crypto, and half of them own NFTs. Most notably, over 90% of crypto buyers are either millennials or zoomers – but they’re merely being outspent by their wealthier elders.

The heightened interest among young people is likely related to their higher risk tolerance. It makes them more willing to stomach the higher volatility of cryptocurrencies, and athletes are certainly no exception.

Young people are also less attached to the traditional investment world than their parents were. They see inefficiencies and lack of accessibility in the old systems and view crypto as comparatively easier to enter. If anything, the always-on nature and democratized ownership of cryptocurrencies are far more familiar to internet-savvy generations.

Perhaps most importantly, youth have a lower-time preference than older generations. Unlike their elders, young people need not worry as often about Bitcoin’s day-to-day price fluctuations to pay bills or support a family. Presented with a window of opportunity to save money early, investing in Bitcoin for the long-term is a proven strategy for profit.

Male Predominance

Sports – especially in the mainstream – is naturally a male domain. As it happens, the investment world is also male-dominated, and so is the crypto community.

A survey conducted by Momentive in August showed that about twice as many men (16%) invest in cryptocurrencies as do women (7%). Likewise, men also trump women on investing in stocks, mutual funds, bonds, and real estate.

This may well be a byproduct of old-school gender norms which put men in charge of household finances. Combined with the fact that the American man’s median income is higher than his female counterpart, one can see why men might have greater opportunities to invest.

Overall, athletes meet a demographic intersection that ticks multiple boxes which predict people’s investment in cryptocurrency. They’re young, male, and are investing during a time of record inflation and economic uncertainty. Then, given that the best athletes have great wealth and notoriety, they gather immediate media interest following their purchases.

Let’s examine precisely who those crypto-loving athletes are. This list is by no means exhaustive, as there are already too many to count.

Athletes Paid in Bitcoin (and their Salaries)

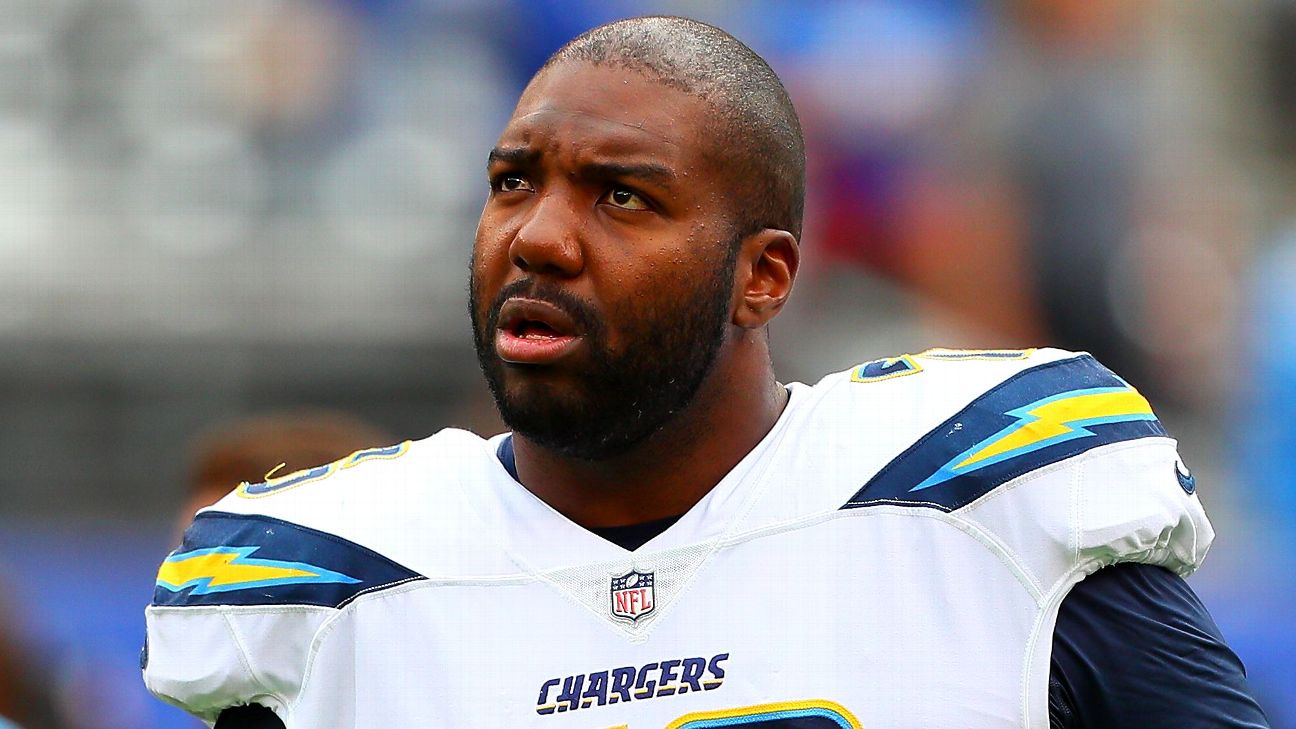

Russell Okung ($6.5 million in Bitcoin)

After 11 years in the NFL, Carolina Panthers’ offensive tackle Russell Okung was the first professional football player to accept a Bitcoin salary. In December of last year, he decided to have half of his $13 million salaries paid in BTC.

This was a follow-up on one of Okung’s viral tweets in May of 2019, in which he said “Pay me in Bitcoin”. After making arrangements with Strike to make this a reality over a year later, he followed up by tweeting “Paid in Bitcoin”.

His timing was impeccable. Bitcoin’s price was about $27k at the time and went on to breach $40k in just two months. To this day, it has never drifted below Okung’s receiving price.

“Money is more than currency; it’s power,” said Okung in a statement. “The way money is handled from creation to dissemination is part of that power. Getting paid in bitcoin is the first step of opting out of the corrupt, manipulated economy we all inhabit.”

Okung commits to Bitcoin long-term and views it as the ultimate future of money in a “post-fiat world”. As we mentioned above, he describes its benefit as protecting holders from having their “labour and time” be stolen.

Saquon Barkley ($10 million in Bitcoin)

In an interview with The Best Business Show, this July, New York Giants Quarterback Saquon Barkley announced that he’d accept all future endorsement deals in Bitcoin. That’s over $10 million of his future income.

Like Okung, Barkley sees Bitcoin as a foundation to build a life around. He said that once he would reach the draft, he knew that it would give him an opportunity to build “generational wealth”.

This term is frequently used in Bitcoin circles to highlight its non-inflationary element, which allows holders to pass value onto their grandchildren in non-asset form. In fact, Swan Signal recently released a mini-documentary by the same name. This may prove that Barkley has been swimming in crypto community circles for a while.

“You see where you are able to go on the draft board and you know that you can break that curse in your family, of creating wealth in your family,” said Barkley. “You start thinking what can I do and what is the safest way. Obviously, I want to be more than a football player.”

Barkley highlighted that to create generational wealth, his sports career will not suffice. Given the limited time span on it and the risk of injury, he would need another growth strategy, in which Bitcoin plays a part.

Trevor Lawrence ($24 million in Bitcoin, Ether, and Solana)

After becoming the number 1 NFL draft pick for the Jackson Jaguars, Trevor Lawrence decided to converted his $24 million signing bonus into crypto. In partnership with Blockfolio – a crypto portfolio tracker – the quarterback diversified across three digital assets: Bitcoin, Ether, and Solana.

FTX CEO Sam-Bankman Fried even congratulated the athlete with another $25k in SOL, on the house.

According to Forbes, part of Lawrence’s interest in partnering with a crypto company was the uniqueness of the partnership. As we mentioned above, athletes that step into the industry early can make headlines and names for themselves.

From Blockfolio’s perspective, COO Sina Nader said that Trevor makes excellent marketing material:

“Trevor is someone people can have a personal and human connection with for us and to the crypto space. We’re really excited about the arena, Trevor and other things we’ll be doing to get ourselves a little more vocal and out there in the space.”

Lawrence represents the sheer opportunity that crypto presents to athletes from an industry standpoint. Even if uninterested in cryptocurrencies themselves, players have enormous sponsorship opportunities in such a rapidly growing field as crypto.

Odell Beckham Jr. ($4.2 million in Bitcoin)

Most recently, Odell Beckham Jr. of the Los Angeles Rams announced that he’d start accepting his entire salary in Bitcoin. Like Lawrence, his Bitcoin income is related to a related industry partnership – this time with CashApp.

“It’s the start of a new era, and I’m looking forward to the future,” tweeted the athlete last month. “That’s why I’m taking my new salary in Bitcoin, thanks to CashApp.”

CashApp was built by Jack Dorsey’s financial payments company “Block” – which recently rebranded from “Square”. The app allows users to both easily purchase and transact in Bitcoin.

Though Beckham’s income is the smallest on this list (still sizable, of course), it didn’t stop him from being charitable. The athlete promised to distribute $1 million in Bitcoin to his over 4 million Twitter followers using hashtags.

Beckham’s Twitter profile pic is that of a crypto punk, meaning he may also share an interest in altcoins such as Ethereum.

Crypto, Athletes, and NFTs

Though the NFL is undoubtedly a honeypot for athletic crypto fanatics, there are still far more outside of football. Ben Askren of the UFC has appeared on Bitcoin Magazine praising Bitcoin’s censorship resistance and anonymity. Naomi Osaka, a Japanese Tennis player, said Dogecoin has introduced her to crypto.

Non-fungible tokens – or “NFTs” – represent unique digital items on a blockchain, identifiable by their own signatures. Simply put, no one can replicate their metadata.

NFTs have presented an incredible opportunity for athletes to further monetize their brand and build fan connections. Using these tokens, sports stars can launch collectible items that are digitally native, opening possibilities beyond the physical world.

For example, Lionel Messi launched his own NFT collection in August featuring unique portrayals of himself. Meanwhile, NBA Top Shot has been selling noteworthy video clips of iconic moments from NBA games to fans. Unlike physical collectibles, the NFTs are incredibly cheap to produce and distribute and may feature programmed returns for the creators on each sale.

Yet athletes aren’t just launching NFTs, but buying them too. In August, NBA superstar Steph Curry purchased a Bored Ape Yacht Club (aka BAYC) NFT for $180k. He and other like-minded athletes have since changed their Twitter profile pictures to match their items.

“People are going to get physical memorabilia with a NFT and that would guarantee the authenticity and the digital scarcity of it,” said Christian Ferri, CEO of NFT Pro.

Ferri predicts that NFTs will grow more influential thanks to athletes. Some may argue that this makes NFTs less valuable. For example, as more come out, they flood the market with increasingly worthless items. However, NFTs’ programmability may give them real use-cases in various virtual settings, including video games.

Conclusion

From Bitcoin to NFTs, athletes stand at a pivotal intersection within the entire crypto-verse. Their own generation is the demographic most interested in crypto, and these superstars bear tremendous cultural influence over them.

Their support and adoption of these technologies is both a rational personal decision and healthy for the broader blockchain ecosystem’s growth. Not only can they help popularise novel items like NFTs, but possibly encourage millions of fans to build generational wealth using the future of financial savings technology.

WhatsApp Integrates Stablecoin Payment Pilot For US Users

Pepsi Slammed For Cringeworthy Use Of NFT Lingo

Written by

More author posts

Publish your own article

Guest post article. Guaranteed publishing with just a few clicks

START PUBLISHING ADVERTISE WITH US